On your mark. Get set. Apply! Applicant Quick Links

JELF's next application period opens August 1, 2025.

Have an account already?

The username is your email!

Getting Started

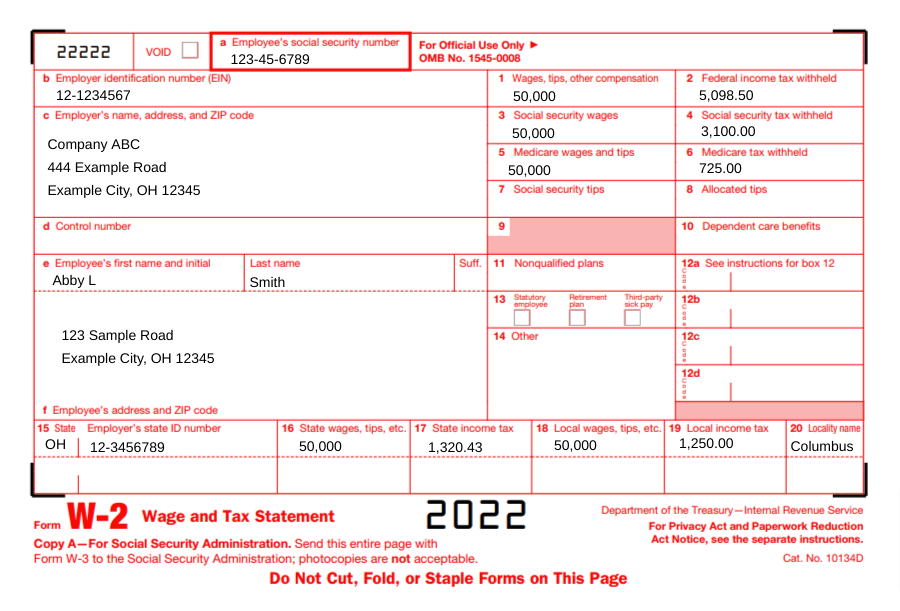

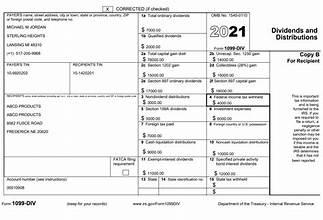

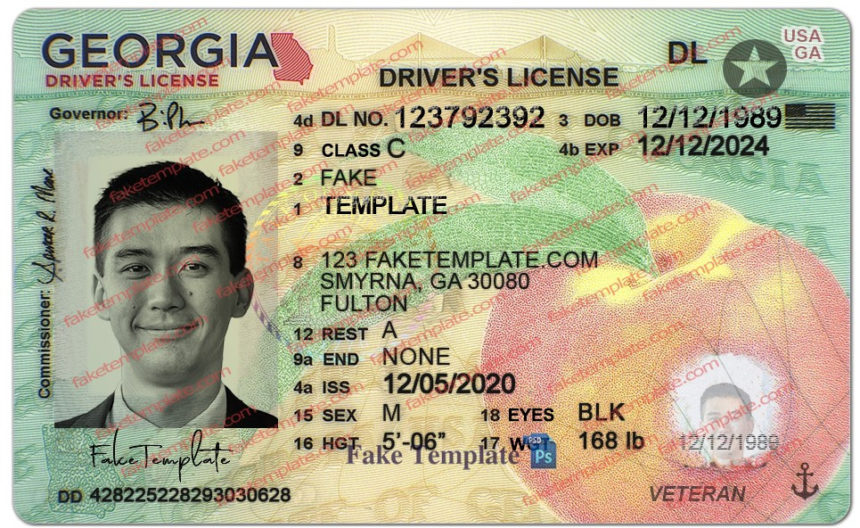

Required Application Documents

Your application is not complete until all required documents are uploaded to the student or cosigner portal.

| Application Type | Deadline |

|---|---|

| Full Academic Year | June 15 |

| Spring and/or Summer Semester Only | October 15 |

The JELF Interview

At JELF, we place great value on getting to know the “whole story," which is why we require both student and cosigner(s) interviews each year. Interviews are conducted by trained professionals, otherwise known as LJAs (Local JELF Administrators). Interviewers are not directly involved in the decision-making process.

JELF interviews help reviewers learn more about the applicant, their educational and career goals and financial needs. They also provide an opportunity for the applicant to convey any other relevant information which may not have been conveyed in the application.

Scheduling the Interview: After submitting your application, you will receive an email with the contact information for your Local JELF Administrator (LJA). Please schedule your interview promptly upon receiving this information.

Repeat Applicants: We aim to pair repeat applicants with their previous LJA. If you need to switch LJAs, inform your JELF contact.

Communication: Please respond quickly to all communications to facilitate the scheduling of your interview.

Duration: The interview will last approximately 30-40 minutes, depending on the applicant's situation. Both the applicant and cosigner should ensure they are available and have the interview scheduled on their calendars, whether in-person or via video conference.

Rescheduling: If you need to reschedule, please contact your interviewer as soon as possible before the meeting. Timely adjustments help avoid scheduling conflicts for everyone.

Purpose: The interview is a key part of the JELF application process. It covers personal topics such as the choice of school and available finances but is designed to be a comfortable conversation.

Consistency: The same information is collected from each applicant to ensure fairness. This data is summarized anonymously and shared with loan reviewers.

Confidentiality: All JELF staff and interviewers adhere to strict confidentiality. Interviewers do not have access to any documentation provided by the applicant or cosigner.

Support: Your LJA can help with questions about JELF, the loan process, college decisions, and general financial aid concerns.

Additional Help: If your LJA doesn’t have an immediate answer, they will work to find it and get back to you as soon as possible.

Contact Us: You can also submit questions anytime through the JELF Contact Form.

JELF Interview Questions

The following categories are a sample of topics and questions presented to both student and cosigner(s) during the interview.

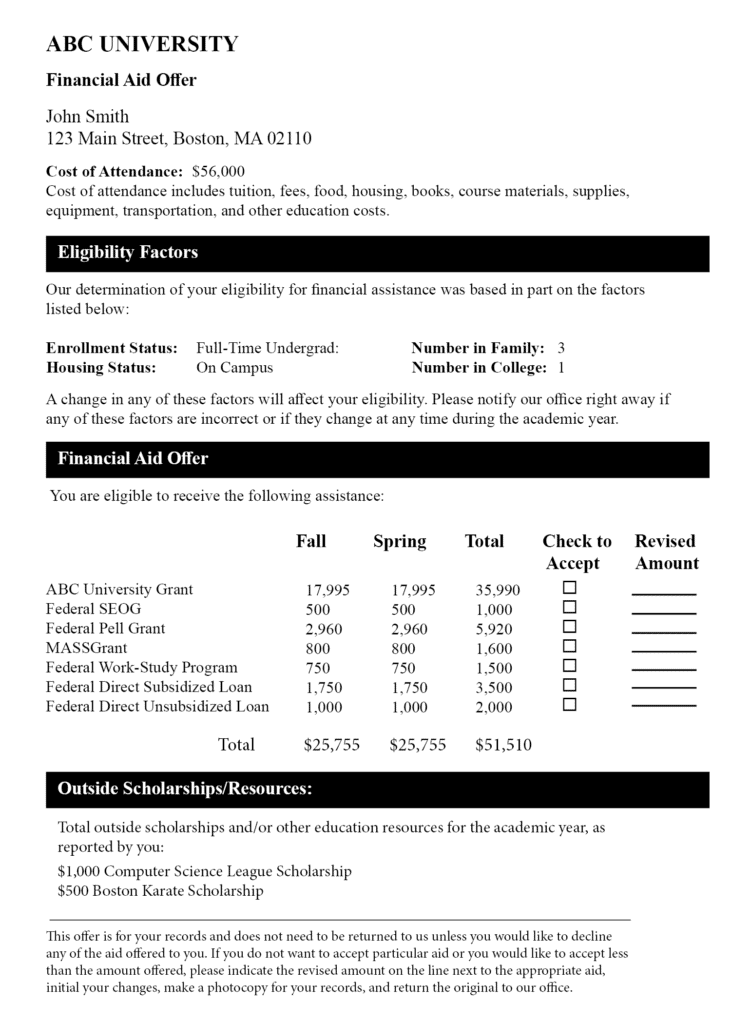

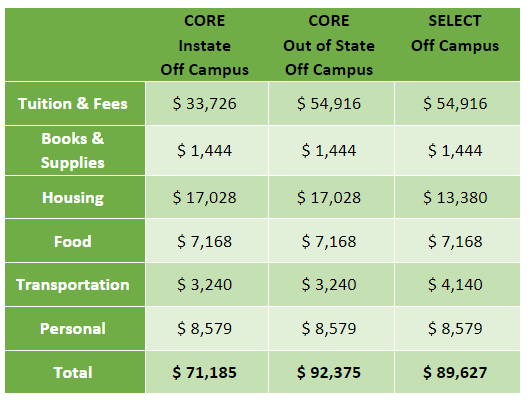

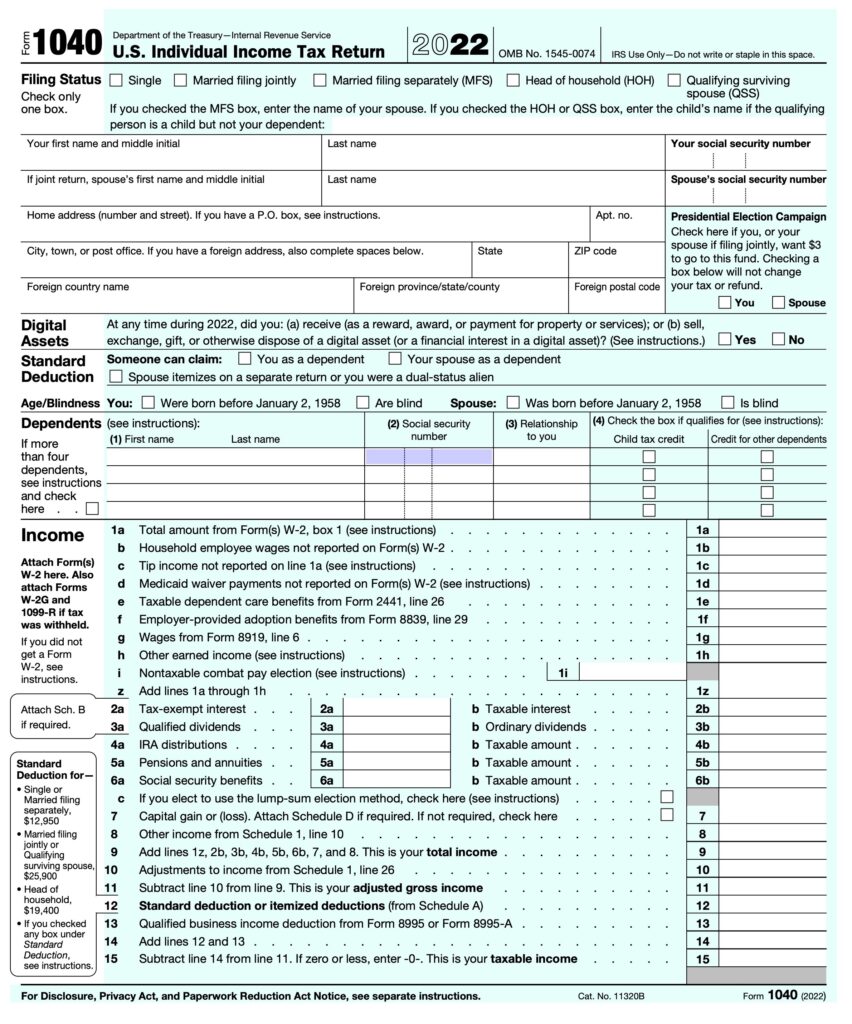

Understanding Financial Aid

Nearly every student is eligible for some form of financial aid. Students who may not be eligible for need-based aid may still be eligible for unsubsidized federal loans regardless of income or circumstances. You can better understand everything related to financial aid here and for even more financial aid resources, visit this site.