About JELF

JELF has one mission.

We lend with a heart.

College costs are rising and JELF is meeting the need through providing no interest loans to Jewish students who demonstrate need for their higher education, which includes undergrad, graduate, vocational or technical school.

Who JELF Serves

JELF is dedicated to the jewish students in

five states

(Florida, Georgia, North Carolina, South Carolina and Virginia, excluding metro DC).

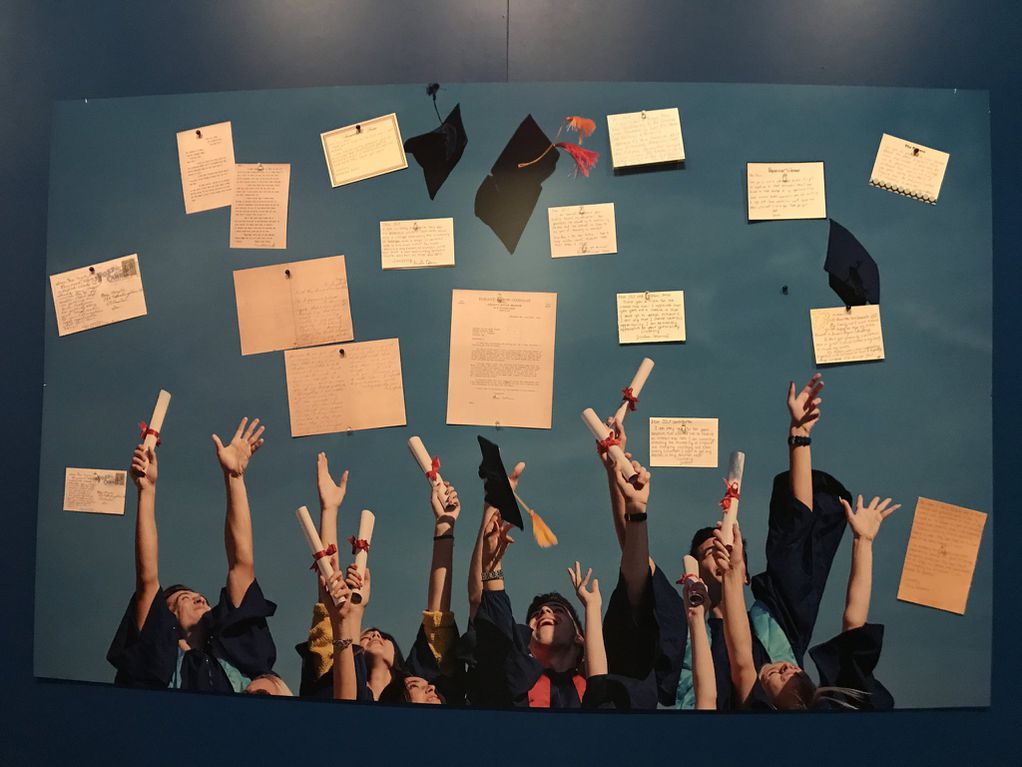

JELF's Impact

Since 1961 JELF has provided interest-free loans to

6,646

students. We now have recipients living all over the world who are active in their own Jewish communities.

Student Choice

JELF believes that students should pursue the academic path that is best for them. Recipients attend a wide range of U.S. accredited college, graduate school or degree-granting vocational programs.

JELF believes that money should never stand between a student and the education they need to excel.

JELF recipients become proud JELF donors and vital members of their Jewish community - in turn helping future Jewish students in need.

438 Recipients This Year

6,646 Students Funded

100% Interest Free

$21.5M Loaned to Date

99% Repayment Rate

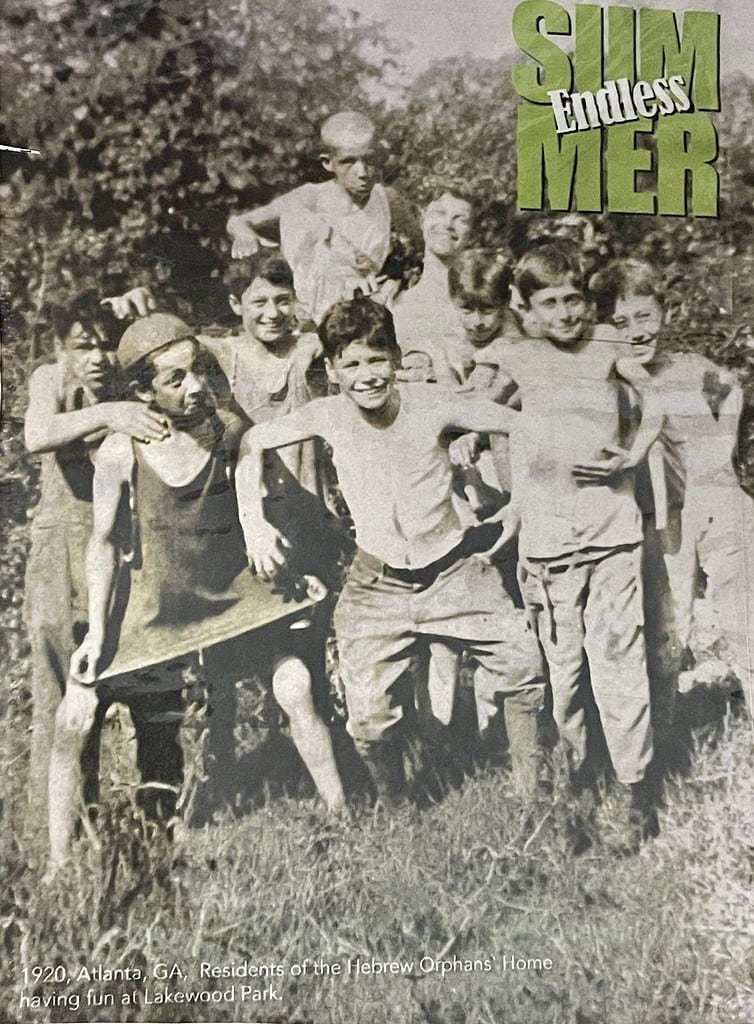

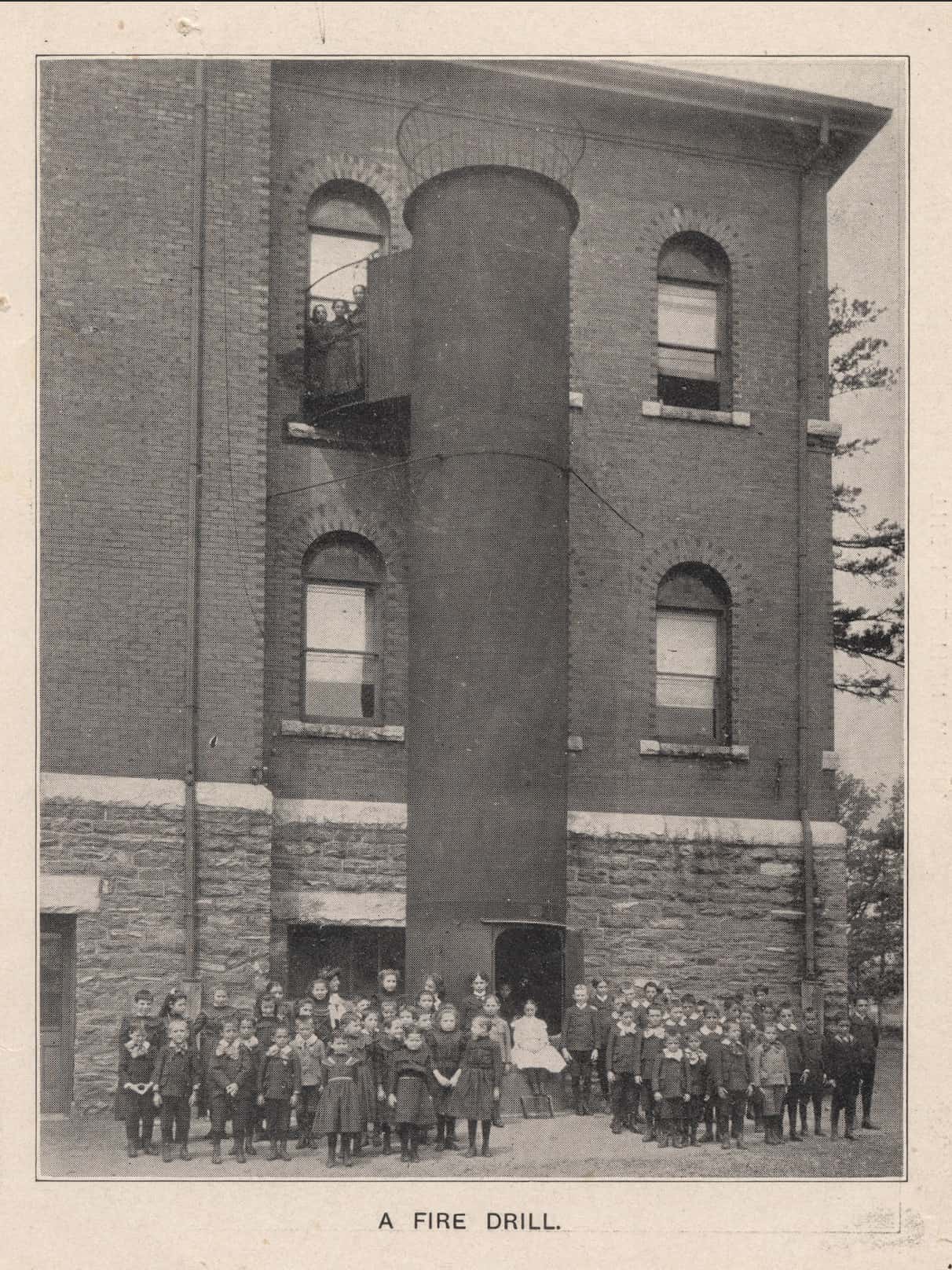

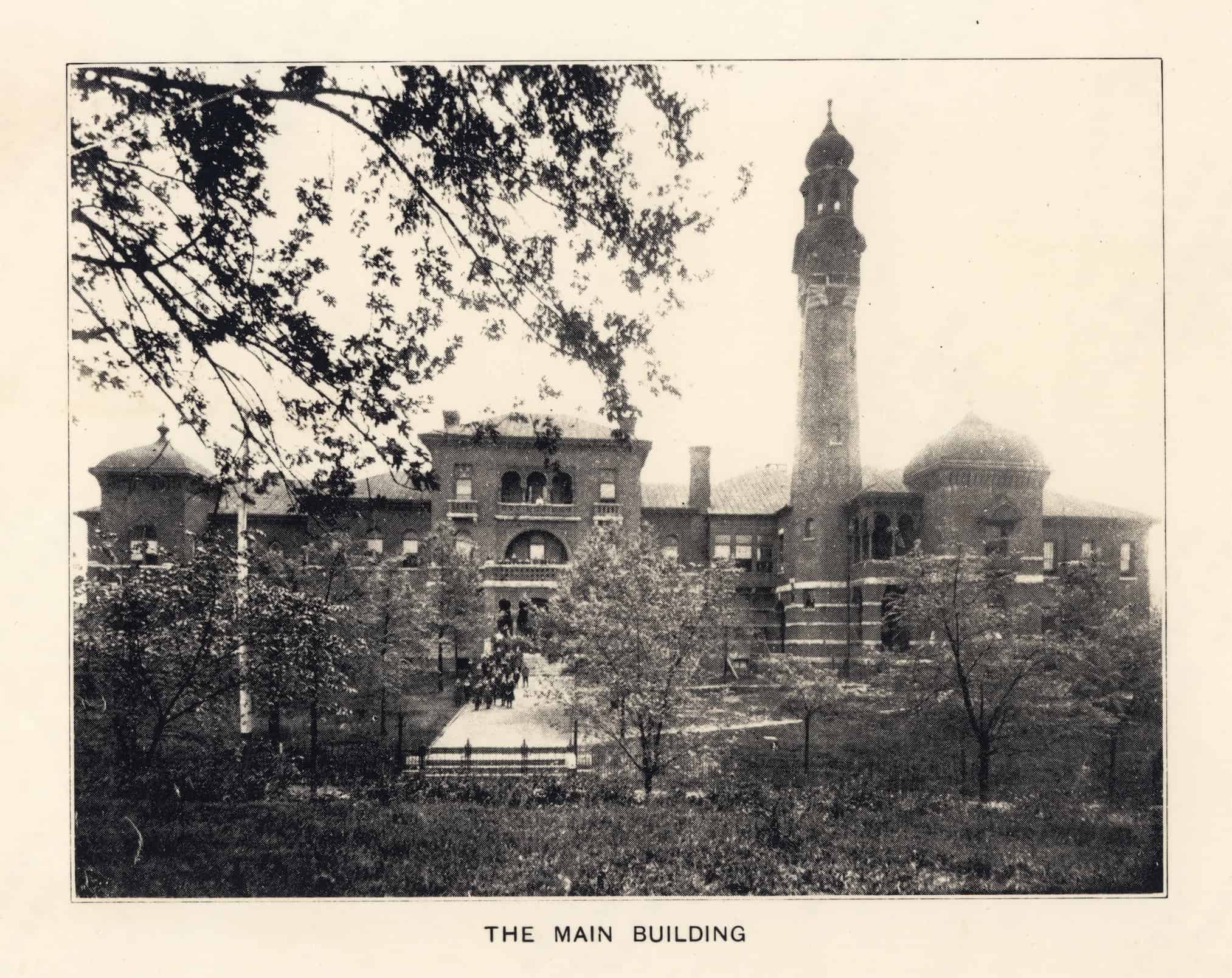

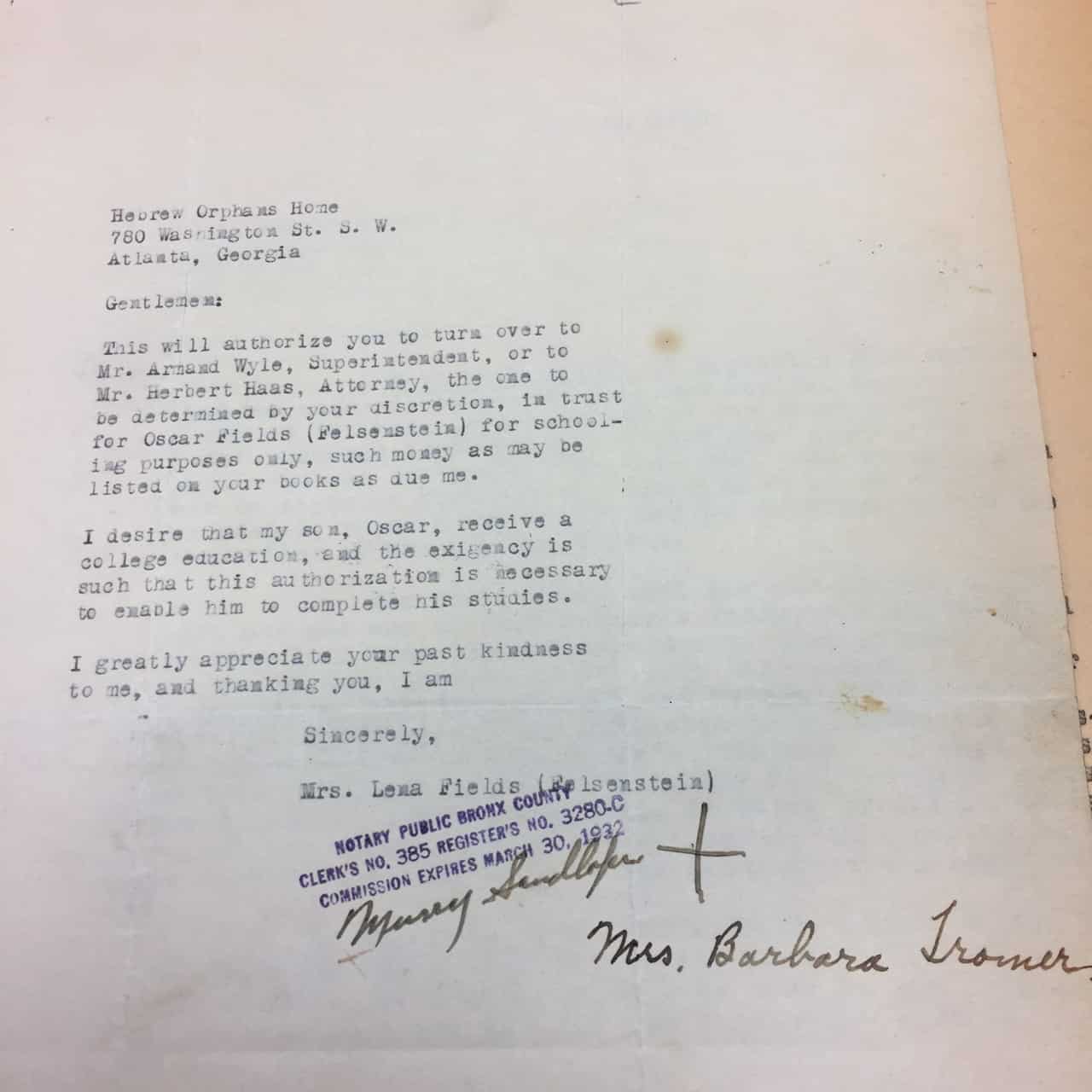

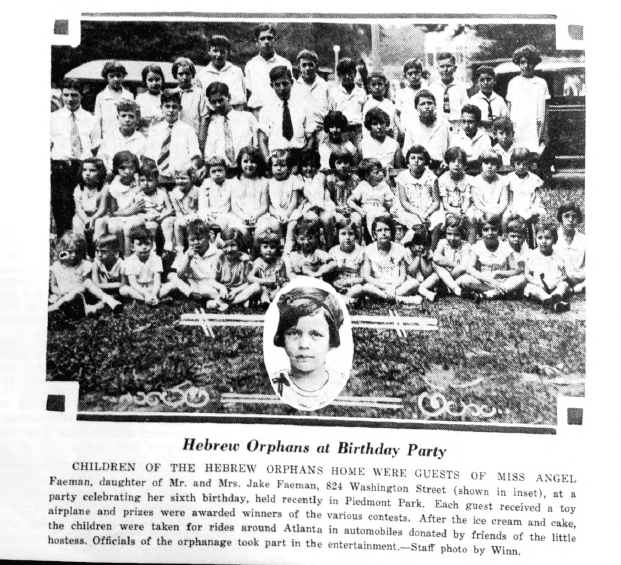

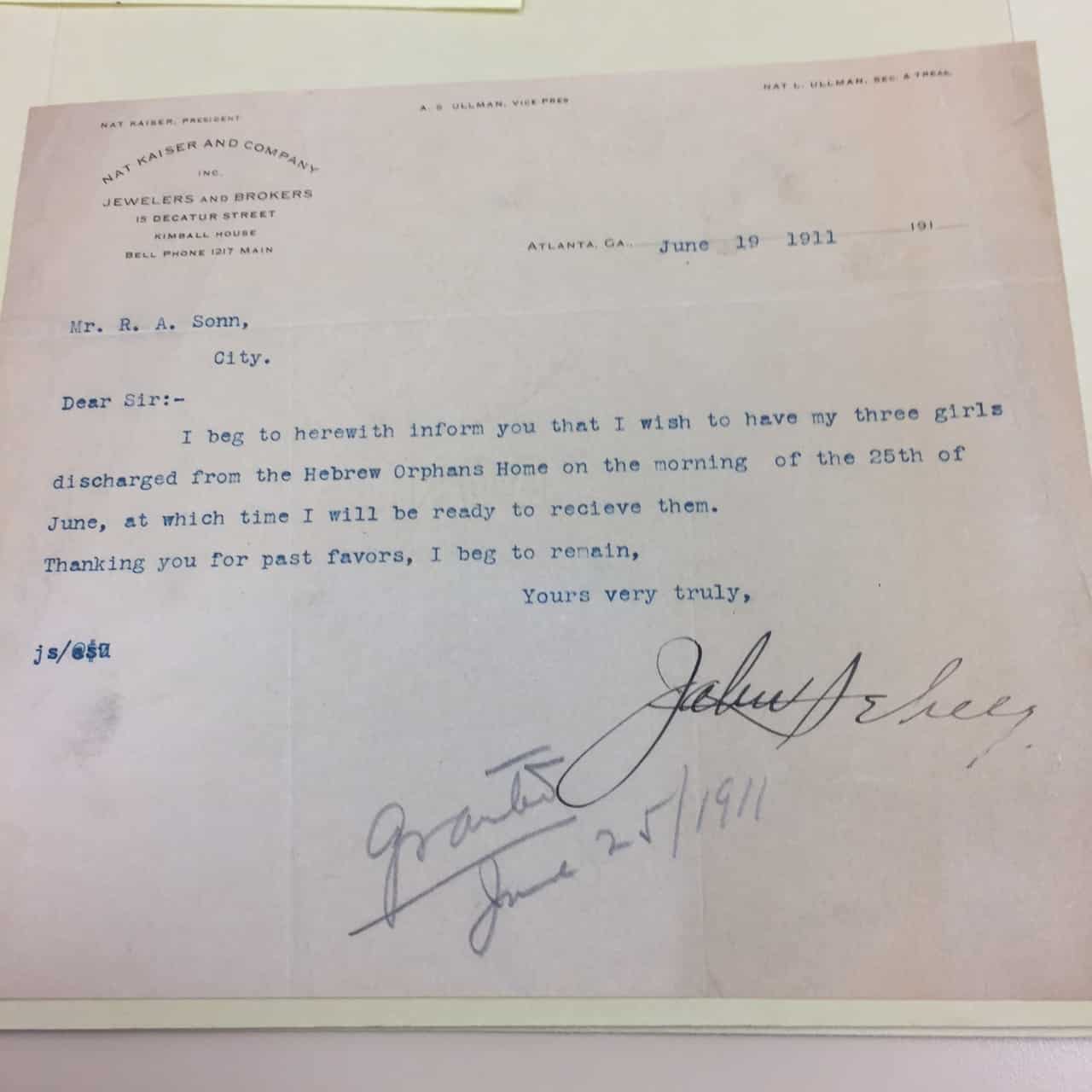

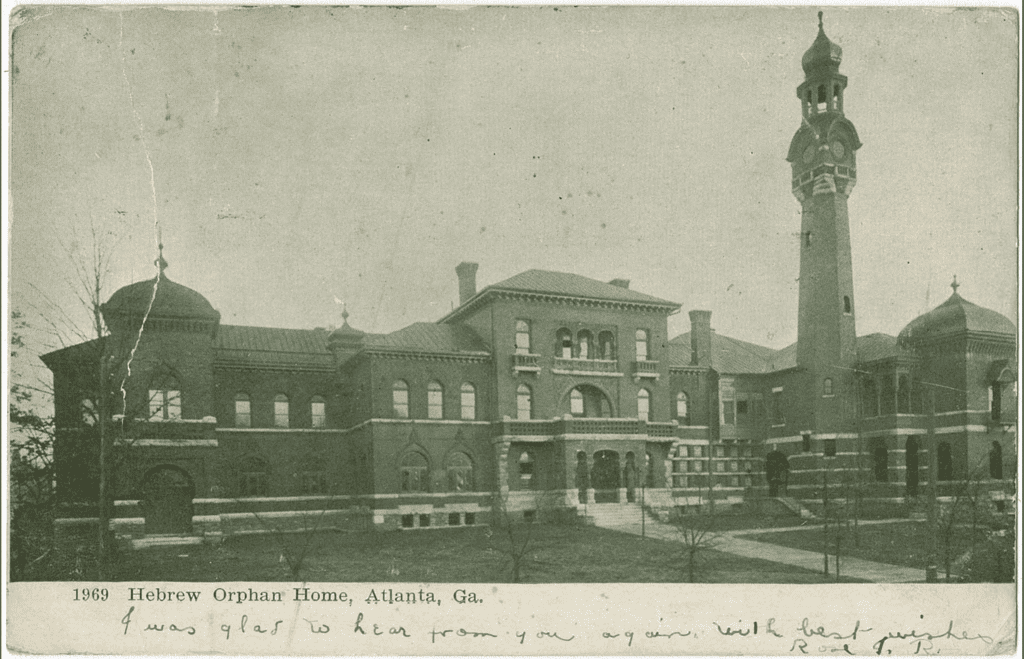

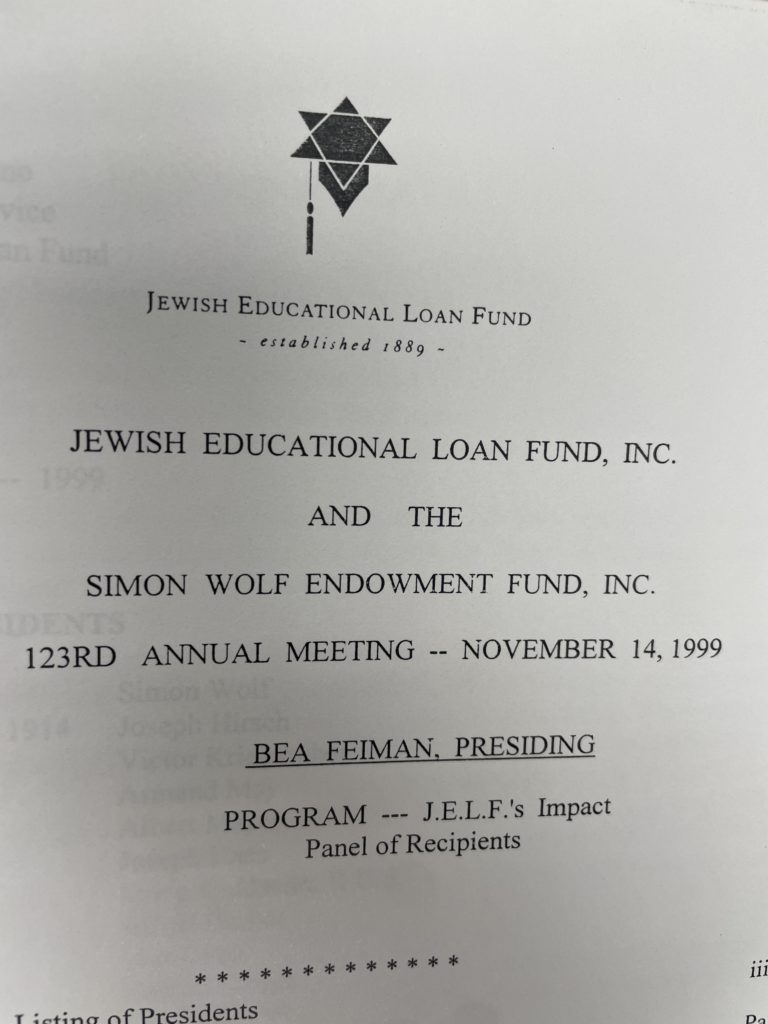

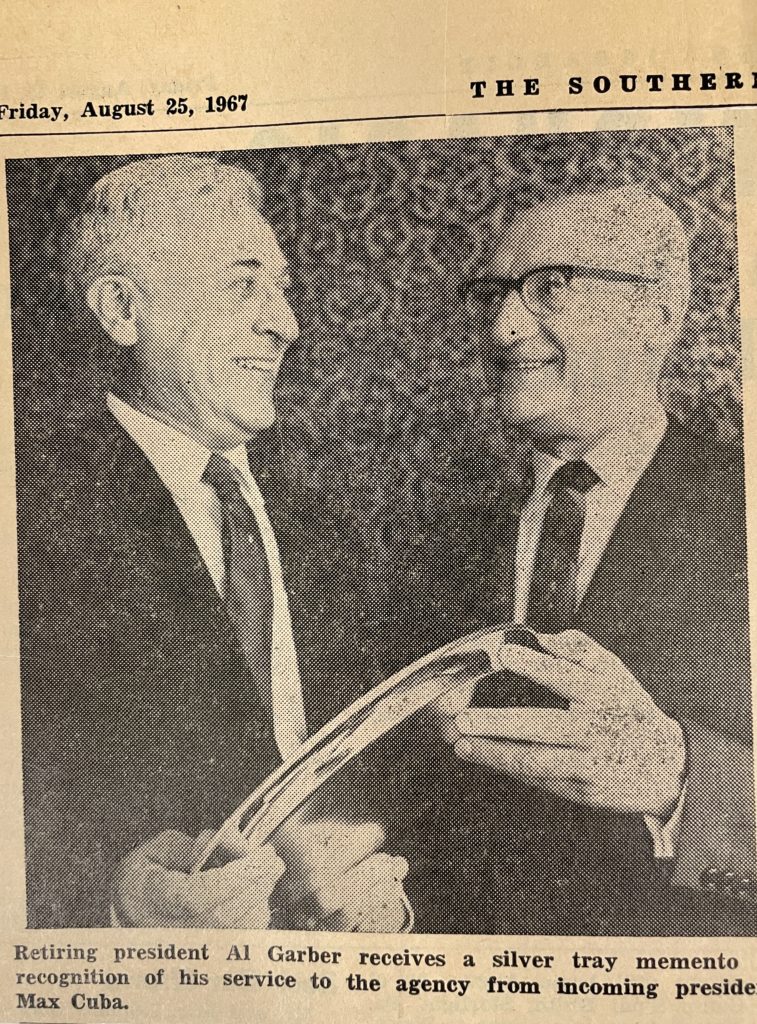

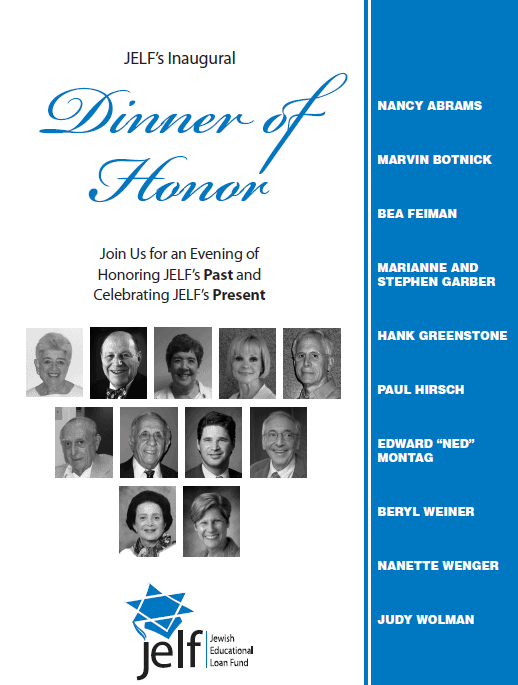

We haven't come this far to come this far! Discover JELF's 150+ year History

Full Circle Stories

chicago, il Megan Williamson

"Because of JELF, I was able to enjoy college life while interning with two non-profits which led to employment at graduation and then became building blocks for the consulting role I am now in.”

raleigh, nc Sara tAYLOR

"JELF was an academic lifesaver for me, allowing me to continue my college career after a sudden death in my family nearly forced me to leave college and head back home. With the help of JELF, I was able to stay in school and earn my BSN. Thank you, JELF!"

How is a JELF loan determined?

1. The cost of the school

JELF calculates the total cost to attend school for the academic year. This includes room/board, transportation, living expenses, supplies and more. JELF then subtracts the student’s total financial resources from the total cost.

2. Student's total financial resources

Students begin by applying online and submitting required documentation. They and their cosigner(s) will then meet with a Local JELF Administrator (LJA) for a personal interview. This meeting allows JELF to gain a comprehensive understanding of the student’s financial situation, going beyond what is reflected in their most recent tax return.

3. Reviewed anonymously and confidentially

Loan applications are reviewed anonymously and confidentially by a team of volunteers who make the final loan decisions. Students are notified via email once the decisions are finalized. After signing a promissory note, funds are disbursed in two equal payments before each semester through ACH transfer.