FAFSA DELAY ANNOUNCEMENT:

We understand that there are FAFSA delays. Please do not wait to submit your JELF application, which is due by April 30. Documents are due June 15. If you still do not have your FSS (FAFSA Submission Summary) at that time, we will work with you to figure out the next steps.

On your mark. Get set. Apply! Applicant Quick Links

New to JELF? Fill out your application between January 1 - April 30.

Have an account already?

The username is your email!

Getting Started

If you are a parent filling this out on behalf of your child, do NOT create an account with your email address. You must use your student's name and THEIR email address. Students and cosigners must be registered using different email addresses.

A verification code will be emailed to the student's email address. After verification, you will create a password, which will be used each time you need to access the application. Parents who are filling this out for their students must have access to receiving this code or they will not be able to complete registration.

If completing an application for more than one applicant, each student's email address must be used to register for their own JELF application.

Required Application Documents

Your application is not complete until all documents are uploaded to the student or cosigner portal. The deadline to upload documents is June 15 for the full academic year and October 15 for spring and/or summer semester funding only. Questions? Contact Us.

If a student is starting a new school or program, they must upload the email or letter from their school, received upon acceptance.

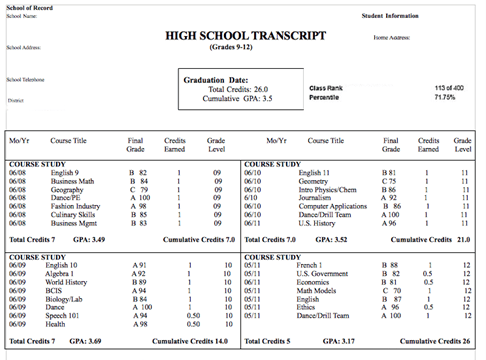

We need a student's unofficial transcript (i.e. grades) through their most recently completed semester of school. This must include the student's cumulative GPA. Students do not need to pay for an 'official' transcript; a screenshot is fine (see below).

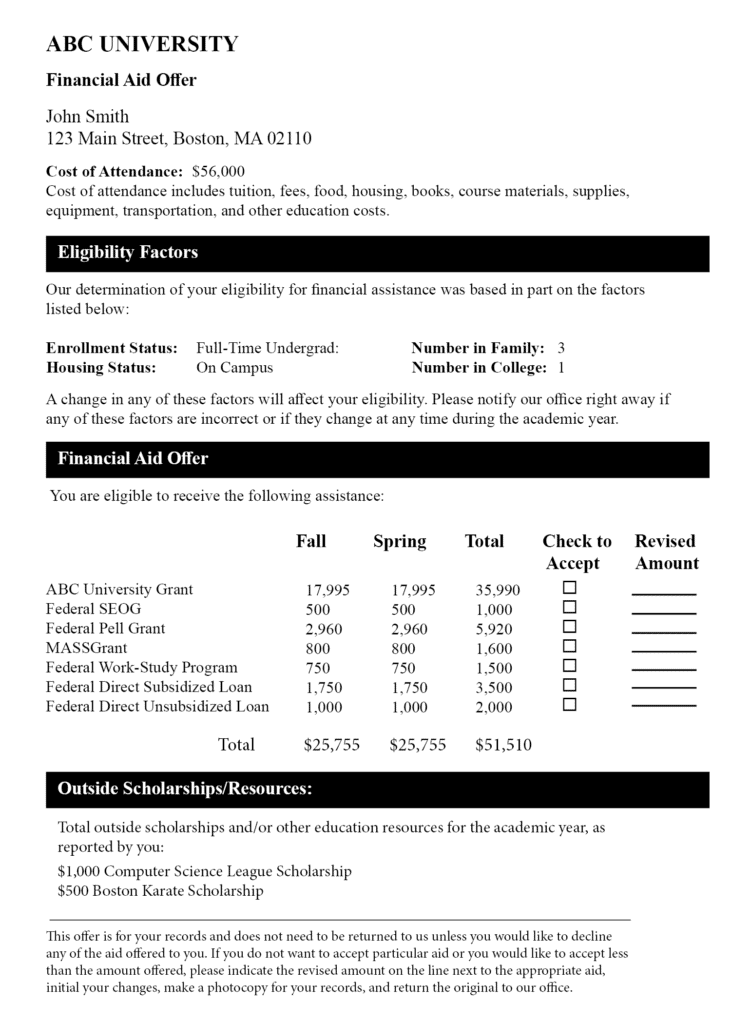

Students will find their Financial Aid Award in their school's student portal. Please ensure that what is sent to JELF is the award for the academic year in which they are applying for a loan, not a previous year's award.

While each school’s award summary will look different, JELF needs the financial aid award that has been ACCEPTED, not just the award letter showing what the student has been offered.

Unless there is a specific exception that prevents the student from being able to accept these loans, JELF requires the acceptance of federal subsidized and unsubsidized loans in order to qualify for our interest-free loans. Exceptions may involve: visa status, school policy or reaching the maximum federal loan allocation.

These are the total federal loan amounts that students are offered for each academic year:

- Freshman- $5500

- Sophomore- $6500

- Junior- $7500

- Senior-$7500

- Second Bachelor’s Degree - $12,500

- Graduate Student – Minimum is $20,500

Each school’s award summary will look a little bit different. Here is a sample:

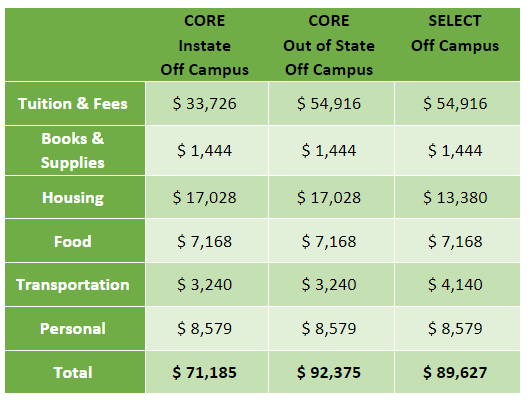

A school's cost of attendance can be found in a student account, the school’s website or within the student's financial aid letter. This document should show the expected breakdown of costs such as tuition, dorm & board, fees, etc. If there are additional costs related to a student's program, students should explain this, including the amount and what the amount covers, in the JELF application.

Sample Cost of Attendance

The FAFSA Submission Summary (previously known as the Student Aid Report or SAR) summarizes the information a student submitted on their FAFSA and provides information about financial aid eligibility based on that information.

After a student's FAFSA form is submitted and processed, they will receive an email from FAFSA with instructions on how to access an online copy of their FAFSA Submission Summary. This will include the estimated eligibility for federal student loans, a Federal Pell Grant (if student qualifies for one), the Student Aid Index (SAI) and whether the student has been selected for verification. Being selected for verification happens at random and does not mean that a student has done anything wrong. Students will need to provide the documentation that is requested of them by a specific deadline to ensure that they can still get federal student aid.

Once a student's FAFSA form has been processed, they can get a copy of their FAFSA Submission Summary by logging in to FAFSA using their account username and password, navigating to your account Dashboard, selecting your processed FAFSA submission, and then selecting the “View FAFSA Submission Summary.” Students must then then save their FAFSA Submission Summary and upload it to the JELF student application through the portal.

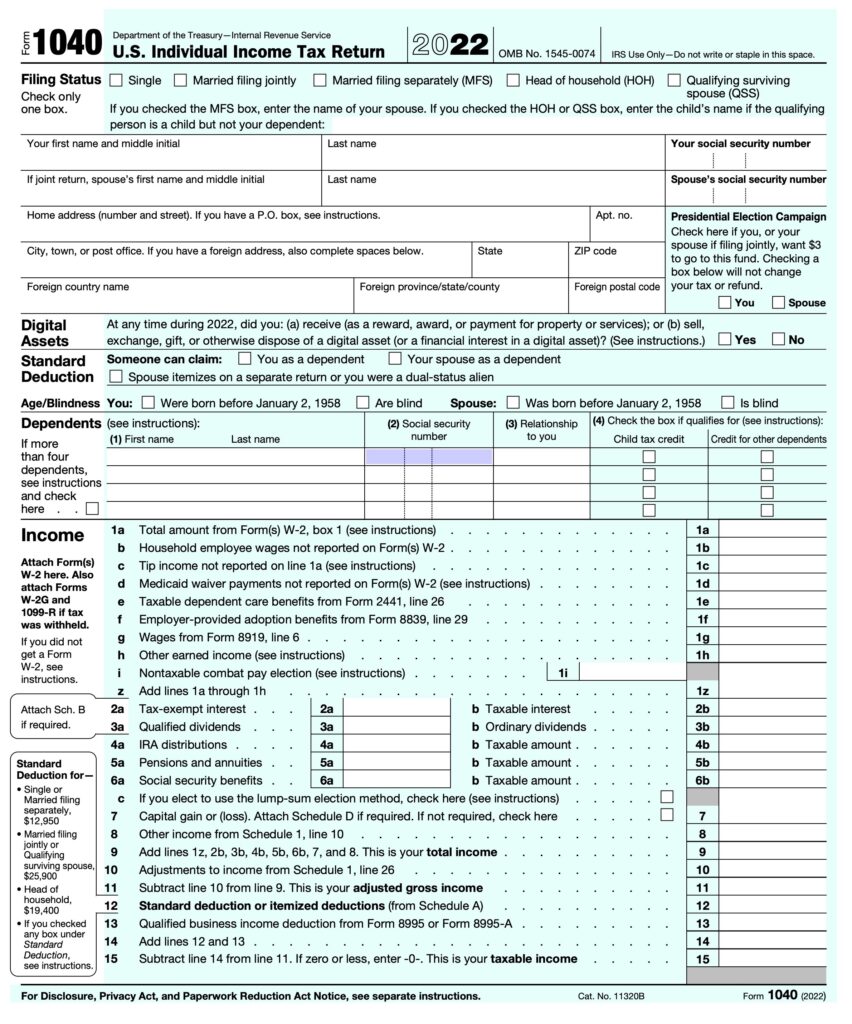

If a student has been employed and filed taxes, they should upload their most recent tax return.

If a student has not worked or filed taxes, please let JELF know and JELF will mark this requirement as complete.

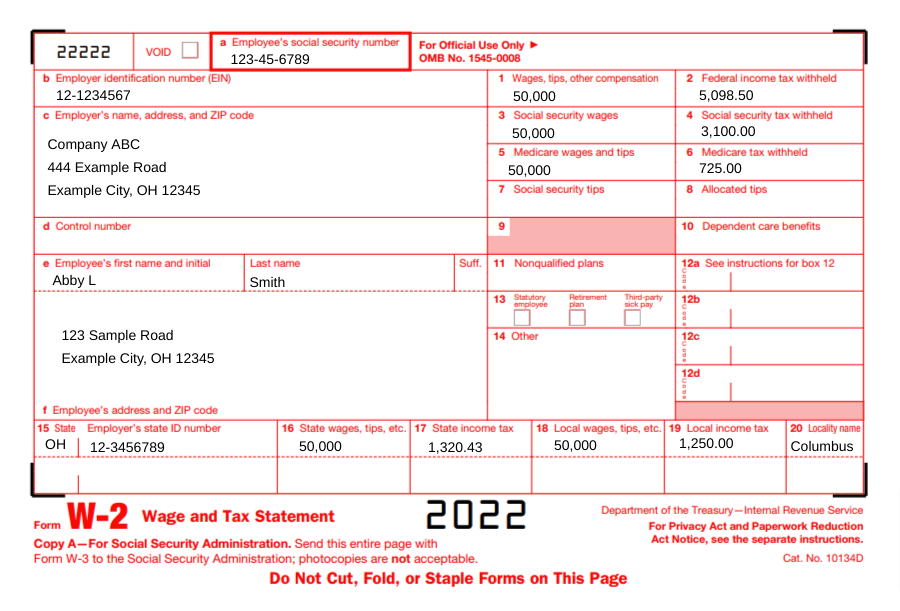

Sample Tax Document:

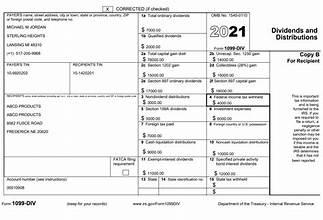

If a student worked during the school year, please send either the W-2 or 1099 Form.

SAMPLE FORM W-2:

SAMPLE FORM 1099:

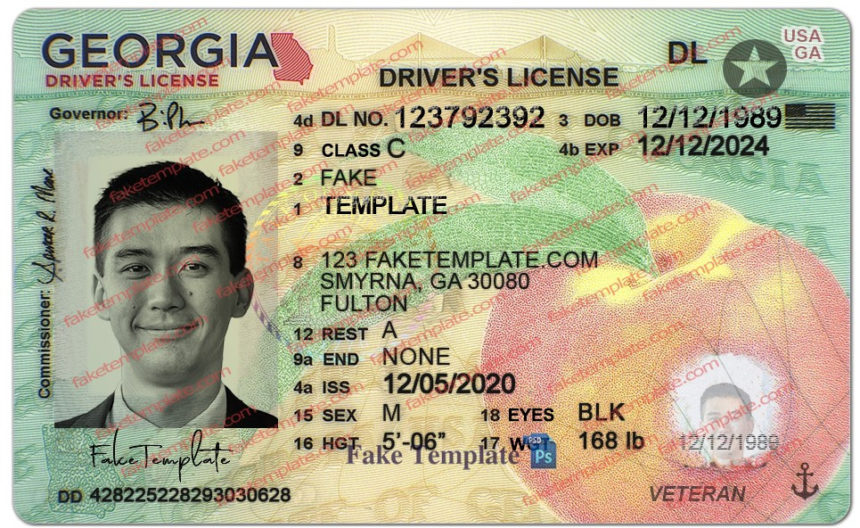

Students will need to upload an image of their driver's license, state ID or passport. The image uploaded must include a photo of the student.

Examples:

You must upload all of the pages that show income. If you get an error that your tax documentation is too large to upload, email them to [email protected], along with your full name and we will upload them to the application for you.

If a parent is serving as the applicant's cosigner and is married and filing jointly, cosigner should send W-2s/1099 for both parents.

If parents file taxes separately and the student is claimed by one parent, but the cosigner is the other parent, send W-2s/1099 for both parents.

If the cosigner is self-employed, upload business taxes.

You must upload either a photo of your state-issued driver's license, other government-issued ID or passport.

The JELF Interview

At JELF, we place great value on getting to know the “whole story," which is why we require both student and cosigner(s) interviews each year. Interviews are conducted by trained professionals, otherwise known as LJAs (Local JELF Administrators). Interviewers are not directly involved in the decision-making process.

JELF interviews help reviewers learn more about the applicant, their educational and career goals and financial needs. They also provide an opportunity for the applicant to convey any other relevant information which may not have been conveyed in the application.

After submitting an application, applicant will be emailed with contact info for the LJA (Local JELF Administrator) who will interview them. It is the applicant's responsibility to schedule this interview shortly after receiving the information.

JELF aims to pair repeat applicants with the same LJA they have previously met with. If an applicant needs to change LJAs, just let your contact at JELF know!

JELF kindly requests a prompt reply to all communication in order to more easily schedule this interview.

Mark the calendar for your interview and plan for it to last approximately 30-40 minutes depending no applicant's situation. You must ensure that both applicant and cosigner each have it calendarized and are available for either in-person or video conference.

If you are unable to make the scheduled time, please reschedule with your interviewer as soon as possible in advance of the meeting. Each LJA has multiple interviews so if you are late or forget about your interview, it causes scheduling difficulties for everyone.

Information gathered during the interview is an important part of the JELF application. While the topics discussed are personal in nature (ranging from why the applicant chose their school and what finances are available for the student for college), the interview itself is meant to be a comfortable conversation.

In order to gain a full picture of each applicant, the same information is collected from each applicant. This information will later be relayed to loan reviewers through an anonymous summary sheet that is presented to loan reviewers.

Confidentiality is strictly enforced with all JELF staff and interviewers. While interviewers are provided with some of the information from the application, they do not have access to any of the documentation provided by the applicant or cosigner.

Your LJA can also assist with other issues that you may need help addressing, such as questions about JELF and the loan process, applicant's college decision or general financial aid concerns.

If an LJA does not have the answer to a question, they will work to help you figure out what you are looking for, and we will be back in touch as soon as possible.

We also welcome your questions through the JELF Contact Form at anytime.

JELF Interview Questions

The following categories are a sample of topics and questions presented to both student and cosigner(s) during the interview.

The interview will typically begin with applicant telling the LJA more about who they are. Example topics include:

- why applicant has chosen their selected school

- applicant's major / concentration

- extracurricular activities, if any

- job (if applicant works or plans to work)

- any goals, hopes, dreams of the applicant's

- applicant's personal financial contribution to college, if applicable

Now let's put together the family puzzle:

- Who are applicant's parents (it is possible one is present during this interview!). Are both parents living? Are they married, remarried, single?

- Are there any siblings? Older/Younger? Where are they now / what do they do?

- Are there any health issues in the immediate family that have contributed to stress over the years?

- Are there any unusual or extenuating circumstances that may be relevant? (e.g. loss of family member, loss of home, accident, trauma, etc.)

Financial questions, which are related to the applicant or family's financial situation, may be best answered by either applicant or cosigner. This is often based on whether the applicant is dependent or independent. In some cases, a parent cosigner may prefer to answer these questions privately, which JELF is glad to provide an opportunity for, and may ask the applicant to recuse themselves at that time.

- How much is the family planning to contribute to the applicant's education?

- Any medical circumstances contributing to the family's financial stress?

- Any significant job loss that has contributed to family's financial situation?

- Are the parents supporting anyone other than the dependents listed in application (e.g. elderly parents)?

- Has there been a bankruptcy? Has there been any business loss?

- Do parents currently (or will soon) pay for multiple children in school at the same time?

- Any other debt that has not already been mentioned (e.g. student loans, mortgages, credit card, etc.)?

There are times where it may not be clear from the application whether a student meets all of the JELF eligibility requirements. In this case, the LJA may ask questions regarding:

- Jewish identity

- citizenship or immigration status

- residency in JELF’s five-state region (FL, GA, SC, NC, VA, except metro DC) for at least 1 year prior to April 30 (or September 30) submission deadline

- enrollment status as a full-time student in a U.S.-accredited institution

- completion of FAFSA (Federal Application for Federal Student Aid) for upcoming school year.

- readiness to accept any subsidized and/or unsubsidized federal loans (offered through FAFSA)

- cosigner status

- applicant's academic standing

Understanding Financial Aid

Nearly every student is eligible for some form of financial aid. Students who may not be eligible for need-based aid may still be eligible for unsubsidized federal loans regardless of income or circumstances. You can better understand everything related to financial aid here and for even more financial aid resources, visit this site.

The FAFSA (Free Application for Federal Student Aid) is a form that can be prepared annually by current and prospective college students in the U.S. to determine eligibility for student financial aid.

These are the main criteria for FAFSA, but for complete list, visit FAFSA.

- U.S. citizen, U.S. national, or eligible non-citizen

- Valid Social Security number

- Enrolled or accepted as a regular student in an eligible degree or certificate program

- Maintains satisfactory academic standing

- Has a high school diploma or GED

- Signs the certification statement stating that:

- They are not in default on a federal student loan and do not owe money on a federal student grant and

- Federal student aid will only be used for educational purposes.

Once you submit the FAFSA, you’ll receive your FAFSA Submission Summary, which details the information you included on the application and your SAI. This summary was previously called the Student Aid Report.

Students must submit the FAFSA each year they are in school to get all eligible federal student loans, grants, work-study and even some private scholarships.

In the 2024-2025 academic year, the Student Aid Index (SAI) replaces Expected Family Contribution (EFC).

The information you input on the FAFSA about you and your family’s financial profile will determine your SAI. The index will equal the sum of your parents’ available income, your income and assets.

Unlike the old EFC, the SAI will not consider the number of family members in college. This means that parents will no longer receive a sibling discount.

The Federal Direct Loan Program (subsidized or unsubsidized), formerly known as the Stafford Loan, is the most standard type of long-term, fixed rate student loans.

No matter what a student's need is, all students receive the same amount from the Federal Direct Loan Program based on what year of school or program they are in:

Undergraduate Students:

- Freshman: $5,500

- Sophomores: $6,500

- Juniors / Seniors: $7,500

Most undergraduates receive a portion of their Federal Direct Loan as subsidized and a portion unsubsidized. However, this depends on demonstrated financial need.

Graduate Students:

- $20,500 / year (with exceptions for law and medical schools).

Since July 2012, graduate and professional students are not eligible to receive subsidized loans.

A federal loan is a broad term for any student government loan that is typically a low-cost, fixed-rate loan available to undergraduate students, graduate students, and parents of dependent undergraduate students.

There are different types of federal loan programs:

- ACG (Academic Competitiveness Grant) – This is a federal grant that may be awarded only to 1st and 2nd year Pell Grant (see below) recipients who have completed specific rigorous high school curricula. Funding is limited, so not all students receive this grant.

- College Work-Study Program – This is a federal program which provides jobs for students who must earn part of their educational expenses. Funds are provided by the government to the school, and an on-campus job is assigned by the school. The amount varies and does not need to be repaid.

- Direct PLUS Loans – These are federal loans that graduate or professional students and parents of dependent undergraduate students can use to help pay for college or career school. There is a loan fee on all Direct PLUS Loans. Interest rates for Direct PLUS Loans = 6.31%. However, if you got your Direct PLUS Loan on or after July 1, 2022, and before July 1, 2023, the loan will have a fixed interest rate of 7.54% after the payment pause ends.

- Graduate PLUS Loan - This is a non need-based student loan which allows graduate or professional students enrolled at least half time at an eligible school in a program leading to a graduate or professional degree or certificate to borrow up to the total cost of graduate education (determined by the school) minus other aid. These loans can be deferred while the student is in school and, if credit is sufficient, a cosigner is generally not needed.

- Parent PLUS Loan – This is a federal loan offered to parents of dependent, undergraduate students who are enrolled at least half time at participating and eligible post-secondary institutions. Good credit, not financial need, is required.

- To receive a Parent PLUS Loan, the parent(s) must not have an adverse credit history. Parents may borrow up to the total cost of the student attending college (determined by the school) minus any other financial assistance received. Repayment begins 60 days after funds are disbursed but may be deferred for a 6-month period after the student graduates. If a parent borrower is unable to obtain a PLUS loan, the undergraduate dependent student may be eligible for additional unsubsidized loans.

- National SMART Grant – Federal SMART grants may be awarded to 3rd and 4th year Pell recipients who are enrolled in specific math or science majors. Similar to the ACG, funding is limited, so not all Pell recipients receive these.

- Pell Grant – This is a need-based grant which is awarded to students with the highest calculated financial need and does not have to be repaid. The maximum Pell Grant is currently $7,395 per year. Eligibility is based on a financial formula. These grants are limited to students with financial need who have not earned their first bachelor’s degree.

- SEOG (Supplemental Educational Opportunity Grant) – Federal loan awarded to Pell Grant recipients who have the highest need. Schools receive a limited amount of SEOG from the federal government, so not all Pell recipients will receive it. Amounts range from $100 to $4,000. The SEOG does not have to be repaid.

Subsidized Federal Direct Loans:

A subsidized Federal Direct Loan means that the government will subsidize the interest while the student is enrolled or in deferment. This loan is awarded on the basis of financial need. Approximately 2/3 of subsidized Federal Direct loans are awarded to students with family gross incomes under $50,000.

Unsubsidized Federal DIrect Loans:

An unsubsidized loan means that the student is responsible for paying the interest on the loan from the minute the loan is granted. Students may, however, have payments deferred until after graduation, at which point they may take 10-25 years to repay. This loan is not awarded based on need, which means that all students are eligible for it. The interest that accrues is capitalized and added to the principal.

Loan Type and Interest Rate:

Direct Subsidized Loan (undergrad) = 4.99%

Direct Unsubsidized Loan (undergrad) = 4.99%

Direct Unsubsidized Loan (grad or professional students) = 6.54%

Graduate students are automatically considered “independent” of their parents for purposes of obtaining federal loans (and completing FAFSA), regardless of their age. If the student is going to medical school, FAFSA recommends that parent sections be filled out because individual medical schools may consider parental information when administering their own financial aid.

Some schools use this information to determine if some of their students are from low income families and therefore may remove the parent expectation and replace it with more institutional aid.

Applicant FAQ

JELF provides “last dollar” loans, allowing students to borrow with no interest for the final dollars needed to pay their expenses. Students apply to JELF after applying for all other student loans and scholarships for which they qualify. Further, since different schools have different costs associated, students have already made their school choice before JELF can determine how much they still need.

For these reasons, JELF applicants must fill out the FAFSA (Free Application for Federal Student Aid) and plan to accept all financial aid for which they qualify, including the Federal Direct Subsidized and Unsubsidized Loans . This loan, which is awarded to anyone who completes FAFSA, is a low interest (as opposed to high interest or 0% interest like JELF) student loan with a set amount per year of school.

JELF’s “last dollar” loans are designed to provide under $8,000 annually, with a $4,500 average loan. Since each student’s need is personally determined based on that student’s true last dollar need, there is no ‘set amount.’

There is no application fee to apply for a JELF loan. Our loans are totally free — no fee and no interest! The only thing a recipient will ever pay back is the money they actually borrow.

JELF serves students who identify as Jewish, which is represented by either lineage or conversion. Applicants are given the opportunity to explain their religious identification in their application.

All students must be seeking a degree and registered full-time at a U.S.-accredited college, university or CTE (Career & Technical Education) Program / vocational school.

Students must have legal residence in JELF’s five-state region (FL, GA, NC, SC, VA, excluding metro DC).

There is no age cap to apply for a loan, though the majority of loan recipients are between the ages of 18 – 25.

Each JELF recipient must demonstrate need through financial documentation and details provided during the personal interview.

JELF serves students from the five-state region of Florida, Georgia, North Carolina, South Carolina and Virginia (excluding metro DC). This five-state region was formed through JELF’s inception as the Hebrew Orphans’ Home (HOH) in 1889, which served B’nai B’rith District #5, the same five-state area JELF continues to serve today.

To qualify, students must provide proof of residency for at least one (1) year immediately preceding the application deadline. JELF verifies a student’s legal address through legal documents, including driver’s license and tax return. While students must prove legal residency within the five-state region, they may attend any U.S.-accredited school.

If you are looking for a Hebrew or Jewish Free Loan agency outside JELF’s five states, most of them are listed through the International Association of Jewish Free Loans.

JELF funds students to attend the U.S.-accredited school of their choice.

JELF applicants must be full-time students attending a university, graduate or vocational program leading to a degree or professional certificate. JELF welcomes applications from undergraduate and graduate students, as well as students who are pursuing a CTE (Career & Technical Education) Program or vocational school.

JELF loans are based on financial need, not a student’s GPA. In order to be eligible (or stay eligible) for funding, all loan recipients must prove to be in good academic standing each semester.

JELF loans are open to students attending U.S.-accredited universities, vocational or CTE (Career & Technical Education) programs. If a school is eligible for FAFSA, it also meets JELF’s criteria. While most universities outside the U.S. are not FAFSA-eligible, JELF has funded students to attend several schools and programs outside the U.S. such as the American Medical Program at Tel Aviv University in Israel which is accredited through NYU. In order to find out if a school qualifies for support through FAFSA, please contact the individual university or program.

The purpose of the personal interview, which involves both the student as well as their cosigner(s), is to learn even more about the applicant and their need. Financial data, such as tax returns, only tell a piece of the story and this information is often over one year old. This in-person or video interview will cover personal questions about the student’s selected educational program, professional aspirations, family dynamics, current financial situation including possible debts, extenuating expenses and more. Click here for more details or to prepare for a JELF interview.

JELF interviews are conducted with the utmost of confidentiality. In most cases, the Local JELF Administrator (LJA) is not an employee of JELF but rather a social worker or like-minded professional contracted through a local Jewish agency. LJAs serve as part of the intake process only and are not involved in funding decisions. After the interview, all of the information is presented anonymously to JELF’s Loan Review Committee along with a summary of the application.

This is not a problem! As long as an applicant has legal residency within JELF’s five-state region, JELF is happy to consider them. Many applicants come from smaller Jewish communities around the region and we will work to ensure that a Local JELF Administrator (LJA) is assigned to each student regardless of their location. Please contact JELF’s Central Office for further assistance.

Once awarded a JELF loan, both the student and their cosigner(s) must sign a Promissory Note accepting and agreeing to the amount. Once JELF has a fully executed Promissory Notes, JELF will deposit the student’s loan through an ACH (automatic bank deposit) after bank account verification. If awarded funds for the full academic year, the borrower will receive half of their loan award in August and the other half in December (assuming they remain in “good academic standing”.

Yes. When filling out the application, most applicants do not yet know their total financial resources. If a student feels that they no longer need to borrow funds from JELF after being awarded their loan, they do not have to accept the loan. Further, JELF appreciates a student or family kindly withdrawing their application from consideration as soon as they discover they no longer need the loan. Students can always reapply for subsequent school years as needed, should they discover a gap in funding.

No, applicants do not request a specific dollar amount. To determine a student’s need, JELF subtracts a student’s total financial resources (including state, school and federal aid as well as possible family contribution) from the total cost to attend school for that academic year.

JELF also compiles a summary of each student’s need using a combination of the FAFSA Submission Summary, applicant and/or parents’ tax returns and the additional financial information provided on the loan application and during the personal interview.

Since financial circumstances and school selected / living costs can all change from year to year, JELF loan reviewers evaluate all loan information and supporting documents annually.

JELF takes both the total cost of the student’s education as well as the family’s total resources into account. We have found that defining need is very personal and different for different families – based not only on household income but also the number of individuals in a household, as well as a medley of other factors related to health or employment that may directly alter what funds exist for a student’s higher education.

Learn more here about JELF’s process for determining each applicant’s loan amount.

JELF loans are awarded directly to the student, not their family or the school they are attending. If a student applies for funding for the full academic year, JELF divides the loan into two equal payments, one at the beginning of the school year and the second in mid-to-late December. It is up to each student to determine how they best need to utilize these funds throughout the semester.

No, JELF does not require Parent PLUS loans. However, if a student’s gap is considerably larger than JELF’s average loan size that school year, JELF may advise a student or family that they need more financial aid before JELF can assist, as JELF loans are ‘last dollar,’ typically covering everything from food to books and healthcare and more.

At JELF, the difference between a dependent and independent student depends on whether the student is relying on any parental support.

- Dependent student – Typically under the age of 25 and is claimed on parents’ income tax form(s) for the previous year.

- Independent student – Typically 25 or older. If under 25, must not be claimed on parents’ income tax form and cannot receive any parental support. If a student is independent and under 25, JELF will require further verification.

A cosigner is someone willing to be legally responsible for a borrower’s repayment if the borrower defaults. While JELF does not charge interest or any fees, we are responsible for ensuring that every dollar loaned is repaid in full. JELF therefore requires a cosigner for each loan made.

All JELF loan recipients must have at least one valid cosigner who resides in the U.S., can provide tax returns, W-2s, and a government-issued photo ID and is not an applicant’s spouse.

While typically a parent, legal guardian or relative, there are other examples of cosigner relationships. All cosigners must complete JELF’s cosigner form (at the appropriate time and after receiving email instructions to do so), including all required documentation.

JELF keeps the identities of its applicants as confidential as possible. Only the appropriate JELF staff and Local JELF Administrator (LJA) who interviews the applicant and cosigner will know that someone has applied for a loan.

We are very sensitive to the issues that cause individuals to seek financial assistance, and therefore ensure our privacy of applicants and cosigners by assigning each application a non-identifying code. Neither JELF loan reviewers or other staff members have access to an applicant’s name or gender.

JELF never sells (or gives) lists of loan applicants to outside parties and will only disclose the name of a recipient with the recipient’s permission.

JELF prioritizes the security of all information throughout the application process. All data collected from students and cosigners is transmitted via our secure email platform and stored on our private, secure server and CRM software. We diligently maintain the confidentiality of your information during its use and promptly delete it when no longer needed. In our six decades of handling educational loans, JELF has never experienced a data breach. If any breach were ever suspected, affected parties would be promptly notified.